Back

Back

Our Market Position Stabilized in Tier-One and Tier-Two Cities with a Higher Gross Profit Margin than Market Average

Net Profit Amounted to RMB 3.46 Billion for the Period

KWG Property Holding Limited (hereinafter referred to as “KWG Property” with the stock code: 1813.HK), as a leading comprehensive real estate developer in Guangzhou, hereby announces the annual results for the year ended 31 December 2016.

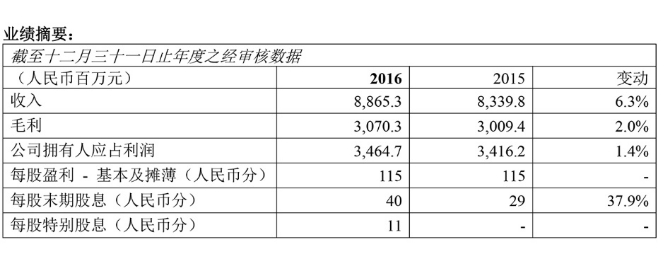

During the year under review, KWG Property’s revenue amounted to approximately RMB 8.87 billion, representing an increase of 6.3% from that for the same period in 2015. The gross profit amounted to approximately RMB 3.07 billion, representing an increase of 2.0% from that for the same period in 2015. The gross profit margin remained stable at 34.6%. The profit attributable to the owners of the Company was approximately RMB 3.46 billion. The core profit amounted to approximately RMB 2.92 billion, representing a year-on-year increase of 12.6%. The earnings per share were RMB 115 cents. The Board proposed a payment of a final dividend of RMB 40 cents per share for the year ended 31 December 2016, along with a special dividend of RMB 11 cents per share.

China’s property market went through a roller- coaster ride in 2016, as buying enthusiasm dominated for some time in the earlier part of the year, before gradually normalize. The property market has been trending up since mid-2015 in the wake of policy relaxations yet more notably in the beginning of 2016. Pent-up demand started to be unleashed in a blowout. Halfway through the year, the sustained exuberance further translated into rather out-of-control price escalation. Property transaction finally began to slow down after the Central Government reintroduced austerity measures in the fourth quarter to curb over-heated market conditions in tier-one and tier-two cities. Record-breaking sales in property led to soaring land prices. Due to the shortage in land supply in tier-one cities, unfulfilled demand shifted to higher tier-two cities, where developers were jumping on the bandwagon to acquire land.

During the year under review, KWG Property launched products to meet customers’ needs and completed its annual sales targets thanks to the strategic positioning in tier-one and tier-two cities over the years. In terms of pre-sales contributions, 51% of the pre-sales were contributed by Guangzhou, Beijing and Shanghai, while the remaining 49% were contributed by higher tier-two cities, notably Hangzhou, Chengdu and Nanning.

KWG Property focused on launching new phases from existing projects after obtaining thorough market analysis. A variety of new products were launched in popular regions to replenish saleable resources in response to heightened buyers’ interest. Products launched by KWG Property during the year were mainly units with GFA of 89–130 sq.m. designed for end-users and first-time upgraders. These were complemented by larger units with GFA of 150 sq.m. or above.

Regarding financial issues, KWG Property closely monitored changes in financing policy and market window, as it successfully issued domestic corporate bonds at favorable interest rates in March and April, respectively, through its wholly-owned subsidiary Guangzhou Tianjian Real Estate Development Limited, to raise proceeds of RMB8,700 million in aggregate. In the latter half of the year, three tranches of non-public domestic corporate bonds with lower interest rates were also issued in July and September through KWG Property Holding Limited to raise a total of RMB11,300 million. In January, KWG Property issued a USD250 million (before related issuance expenses) senior note to replace USD senior notes issued in previous years with higher coupon rates. Such issuances have significantly lowered our financing costs and improved our debt profile, while gradually reducing the proportion of offshore bonds to lessen foreign exchange exposure.

Regarding land bank, to continue with its stance in tier-one and higher tier-two cities over time, KWG Property acquired 12 sites located variously in Guangzhou, Foshan, Shanghai, Hangzhou, Nanning, Chengdu and Hefei during the reporting period to facilitate expansion in scale and sustain future development. During the year, KWG Property acquired new sites with an attributable GFA of approximately 2,374,000 sq.m. As at 31 December 2016, KWG Property owned 67 projects in 12 cities across China with an attributable land bank of approximately 11.3 million sq.m., sufficient to meet the development need of KWG Property in the next 4-5 years.

KWG Property’s hotel operations and investment properties maintained stable growth during the year. KWG Property had five hotels in operation, including Four Points by Sheraton Guangzhou, Dongpu, Sheraton Guangzhou Huadu Resort, W Hotel Guangzhou, as well as The Mulian Hotels in Guangzhou and Hangzhou. After years of improvements, these hotels have built solid reputation and enjoyed steady growth in revenue by maintaining and expanding customer bases through premium services and business- friendly environments.

KWG Property launched U Fun, the green shopping centre in Xinjiangwan, Shanghai and Tian Hui Plaza, a high-end shopping mall in the Pearl River New Town, Guangzhou during the year, in addition to office properties for lease in various cities, The launch of commercial projects is set to contribute stable cash flow to KWG Property on an on-going basis. IFP has been able to maintain a high occupancy rate consistently for long periods. Such success is mainly attributable to convenient location at the heart of Pearl River New Town, as well as pleasant working environment and excellent property management services. IFP reported an occupancy rate of 98.8% as at 31 December 2016 as it continued to stay atop peers in the region in terms of occupancy rate.

Looking into the future, Mr. Kong Jianmin, as Chairman of KWG Property, commented in his statement, “We are scheduled to launch a great number of brand new projects in Guangzhou, Shanghai, Foshan, Nanning and Hangzhou in 2017. These will include Zhucun Project in Guangzhou, Songjiang Project in Shanghai, Beijiao Project in Foshan, Wuxiang New City Project IV in Nanning, Xiaoshan Project and Shenhua Project in Hangzhou. The new projects will comprise mainly residential for end-users and upgraders. In the meantime, we also look to launch new phases of existing projects which have been quite established in their respective local markets, such as The Summit in Guangzhou, Oriental Bund in Foshan, Sky Ville in Chengdu, The Moon Mansion in Hangzhou and The Core of Centre in Nanning, to ensure timely replenishment of saleable resources.”

Founded in 1995, KWG Property (HK Stock Code: 1813) has been committed to developing the middle-end and high-end properties, operating as a leading real estate developer in Guangzhou. Over twenty-two years of development, KWG Property has successfully established its diversified real estate development system, comprising middle-end and high-end residential projects, service-based apartments, villas, office buildings, hotels, shopping centers, and other various real estate development projects. In recent years, KWG Property has been vigorously expanding its business presence across the country, gradually encompassing Guangzhou, Foshan, Hainan and Nanning in South China, Suzhou, Shanghai, Hangzhou, Nanjing, Hefei and Xuzhou in East China, Chengdu in Southwest China, Beijing and Tianjin in North China, and Wuhan in Central China. During the year, KWG Property also established its foothold in Hong Kong, elevating its national strategic positioning to the next level.